Latest Facts and News

- Increased Thresholds: Many states have raised the asset threshold for small estate affidavits due to inflation.

- Probate Avoidance: Recent legal updates emphasize the benefits of avoiding probate through affidavits.

- Digital Affidavit Options: Some jurisdictions now offer digital filing for small estate affidavits.

Losing a loved one is tough, and dealing with legal matters like life insurance claims or estate management only adds to the stress. The long waits, confusing paperwork, and probate uncertainties can feel overwhelming, especially when you need financial relief.

But there’s a simpler way.

A small estate affidavit life insurance helps you access payouts and transfer assets without the hassle of probate. It streamlines the process, giving you one less thing to worry about during difficult times.

In this blog post, we’ll break down everything you need to know—eligibility, submission steps, and common mistakes to avoid. Plus, with SWAT Advisors by your side, life insurance planning becomes effortless.

Let’s dive in.

What is a Small Estate Affidavit Life Insurance?

A small estate affidavit life insurance is a legal document allowing heirs and beneficiaries to claim the assets of a deceased person. This includes life insurance benefits, without undergoing formal probate. It is designed for estates below a specific asset threshold as stated by different states.

It is a simplified process that saves time, and cost and avoids the probate process. The main purpose of a small estate affidavit is to streamline asset distribution when the deceased’s estate is small.

Role of Small Estate Affidavit Life Insurance

Streamlining Claims

A small estate affidavit makes it easier to claim life insurance funds because it allows heirs to avoid going through probate. This is particularly useful when:

- No Beneficiary is Named: In case of no beneficiary designation, the money goes into the deceased’s estate.

- Quick Access is Needed: Families often require immediate funds for expenses such as funerals.

Avoiding Probate

Probate is often time-consuming and expensive, delaying access to the insurance funds. Normally, if there’s no beneficiary mentioned, the life insurance money has to go through a legal process called probate. This process makes sure the deceased person’s will is valid and helps distribute their assets.

However, using a small estate affidavit life insurance can avoid probate and is useful to:

- Save time: Processing time is reduced significantly as heirs can claim the funds without waiting for probate, making the process faster and more efficient.

- Minimize costs: Legal fees associated with probate and court fees are avoided.

How Small Estate Affidavits Simplify Life Insurance Claims?

Small estate affidavits are a game-changer for families managing life insurance claims. Here’s how:

Advantages of Using a Small Estate Affidavit

A few advantages of using a small estate affidavit life insurance and probate avoidance are listed below:

- Faster Access to Funds: A small estate affidavit is a simple and faster alternative to formal probate as heirs receive payouts without waiting months for probate to conclude.

- Reduced Legal Costs: No need for attorneys or probate fees, thus reducing financial burden.

- Simplified Process: It is easy to understand and file. After it is signed and notarized, it legally authorizes direct asset transfers to chosen heirs.

Eligibility Criteria for Filing a Small Estate Affidavit Life Insurance

The criteria for qualifying to submit a small estate affidavit for life insurance depends on the value of the deceased individual’s estate. This figure can vary significantly from one state to another. Thus, it is crucial to verify local regulations.

Typically, only relatives like spouses, children, parents, partners, or designated executors of an estate are permitted to use small estate affidavits. Nonetheless, the individual must demonstrate their connection to the deceased

State-Specific Thresholds

One big difference is how states define the value of a small estate. Different states in the U.S. have different laws and state thresholds for small estate affidavits. In some places, an estate is only considered small if its total assets are worth less than $10,000 while others have significantly higher limits.

Here are some examples of state thresholds as per 2024 data:

| State | Small Estate Affidavit Threshold Limit |

| California | $184,500 |

| Texas | $75,000 |

| Connecticut | $40,000 |

| Oregon | $275,000 |

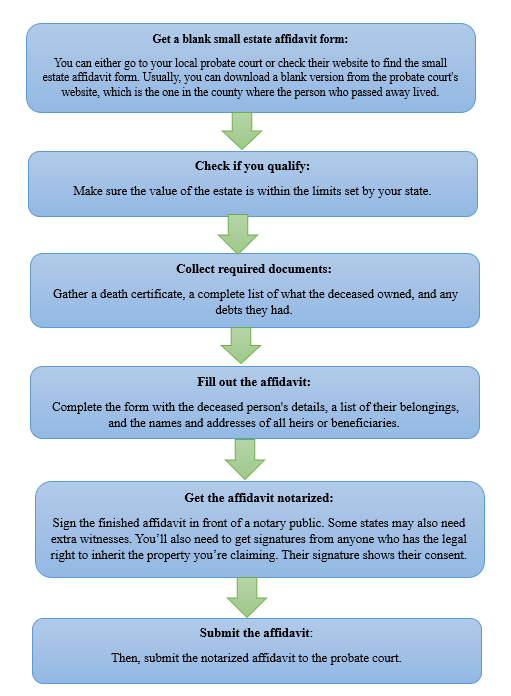

Steps to Filing a Small Estate Affidavit for Life Insurance

Before filing an affidavit, you must know how to prepare one, gather all the necessary documents, and understand the state-specific laws.

Below is the step-by-step guide you need to file a small estate affidavit:

Finally, wait for the court to transfer the property to you. After the court approves the affidavit, you can start distributing the assets as mentioned in the document.

| Pro Tip: Although filing a small estate affidavit independently is simple, hiring an attorney can help clarify complex legal terms and ensure the form is filled out correctly. Legal professionals like SWAT Advisors can guide you on the same. |

Required Documentation

Various documents and attachments may need to be included such as:

- A certified copy of the death certificate

- Proof that the decedent owned the property (like a bank passbook, bank statement, storage receipt, or stock certificate)

- Proof of your identity (like a driver’s license or passport)

- Estate inventory list

- Affidavit form (state-specific)

- A list of heirs such as offspring or spouses, with their signatures agreeing to the use of the small estate affidavit

- Details such as statements establishing the extent of any debts or claims against the estate

Common Mistakes to Avoid

Creating and filing a small estate affidavit life insurance takes careful planning. If you commit errors, it can cause delays in asset distribution, disputes, or even legal proceedings. This part focuses on some common mistakes to avoid errors and also provides useful tips for making the document correct.

- Wrong Asset Valuation: If you undervalue or overvalue assets, it can mess up the true value of the estate. It’s a good idea to get professional help with important things like real estate or valuable antiques.

- Ignoring Debt and Taxes: When someone passes away, their debts and taxes remain. If you forget to consider these, it could create problems for the heirs with creditors.

- Counting Non-probate Assets: Another mistake people make is including non-probate assets, like life insurance payouts or retirement accounts with specific beneficiaries, in the estate’s total value. These assets go straight to the people named, so they don’t count as part of the estate.

- Not Getting Legal Help: While it’s not always required to have legal advice, skipping it can lead to expensive errors. Since estate laws can be very different depending on where you are, having a legal expert can help to understand and follow laws correctly.

Tips on preventing errors when filing an affidavit

You don’t want to commit errors while filing an affidavit. So, here are some tips that you can use to prevent those errors.

- Collect All Important Information: The first big step is to gather all the important documents like deeds, bank statements, car titles, and personal belongings. Having a complete list helps show the total value of the estate.

- Know What Counts as Assets: It’s important to understand what counts as an asset when dealing with a small estate affidavit. Usually, this includes personal items, money, and property. But there might be some exceptions, like property owned jointly with someone else.

- Verify the Right Heirs: Make sure the affidavit correctly lists the rightful heirs and beneficiaries according to the law or the will of the person who passed away.

- Use Correct Information: When you file a small estate affidavit for life insurance, provide accurate and verifiable information about asset values, beneficiaries, and any debts the deceased had. If the information is wrong, whether on purpose or not, it could result in legal trouble or delays in distributing the assets.

- Look for Alternate Beneficiaries: Always check the life insurance policy of the person who passed away for any alternate beneficiaries. If there’s a named beneficiary, the life insurance won’t be included in the probate estate.

- Confirm Estate Worth Against State Thresholds: As previously stated, the thresholds for small estate affidavits vary between different states. It’s crucial to ensure that the total assets of your family member in probate fall within the permitted limits. If they go beyond this limit, you won’t be able to utilize a small estate affidavit, and you’ll need to follow the standard probate procedure.

- Add a Sworn Statement: The affidavit should contain a sworn declaration affirming that all information within it is accurate. Always understand the serious legal consequences of this.

Final Words

Small estate affidavits are really helpful when there isn’t a clear beneficiary or when the total assets in probate are below the state limit. It’s super important to know that these limits can change depending on where you live, so you should check your local laws. Filing a small estate life insurance is easier, time-saving, and cost-effective than going through probate court.

By following the specific requirements of your state and taking the right steps, you can skip the long and costly probate process, making it faster to distribute assets.

However, it’s always a good idea to talk to a legal expert like SWAT Advisors to make sure you’re choosing the best option for your situation. This way, you can manage estate matters more effectively and reduce the financial strain that often comes with losing someone you care about.

Get your personalized help for small estate affidavits and life insurance planning now with SWAT Advisors.

FAQ's

Different states allow different assets to be claimed under small estate affidavits. A small estate affidavit can be used to claim the following items from a deceased person’s estate.

- Bank accounts, including payable-on-death accounts

- Retirement accounts with named beneficiaries

- Life insurance policies with named beneficiaries

- Jewelry

- Clothing

- Furniture

- Boats

- Motor vehicles

A small estate affidavit is way quicker than going through formal probate. The time it takes can differ by state, but it usually wraps up in a few weeks to a few months after you file it.

Each state has its guidelines for small estate limits and what’s needed for the affidavit, but they all try to speed things up since the process is simpler. If you get all the required paperwork done right and submitted, it’ll go even faster.

Yes, a small estate affidavit can be used even if there is a will if it follows certain criteria as follows:

- The person using it is the designated executor of the will as only he can use the affidavit to distribute assets from the will without going through full probate proceedings.

- The total value of the deceased person’s assets must fall under the state’s definition of a “small estate” to qualify for using an affidavit.

If the estate surpasses the limit for a small estate affidavit, the heirs are required to follow the regular probate procedure to allocate the assets. A formal probate process is generally more complicated and takes longer than a straightforward affidavit. This indicates that the heirs must submit an official request to the court to manage the estate, which could entail court sessions, legal costs, and a more complex documentation process.

Indeed, a small estate affidavit must be notarized in the majority of states to confirm its validity. This indicates it needs to be signed before a notary public to be deemed authentic and legitimate. You can continually verify your state’s particular requirements to be certain.